Get a head start on your savings allowance

New tax year, fresh start. Make the most of your 2025/26 ISA allowance with a Stocks and Shares ISA, a Lifetime ISA, or both within one Plan. Capital at risk.

New tax year, fresh start. Make the most of your 2025/26 ISA allowance with a Stocks and Shares ISA, a Lifetime ISA, or both within one Plan. Capital at risk.

US tariffs impact the markets - Read our article about market volatility and how movements in the market are normal

Our customers and members rate us 4.7 out of 5 for our service

2.5 million customers trust us with over 5.2bn funds to look after

Managing family finances and making a positive impact for over 150 years

Financial Advisers, expert investment managers, and exclusive benefits

Grow your savings in a tax-efficient ISA for all your life's big moments, providing better potential returns for medium to long-term saving.

Invest your savings towards your first home and/or later life with a 25% Government bonus - up to £1,000 each tax year, as an extra helping hand.

Invest for their tomorrow, today. Start saving towards a head start into adulthood from as little as £10 a month. Family and friends can gift money too.

As a well-established CTF provider, we may look after your savings, or maybe you want to transfer to us; either way, we are here to help.

Our Savings & Investment Plans are designed to provide flexible investing for your future, with no limit on the amount you can invest.

If you don't already have a workplace pension and want to start saving for a comfortable retirement, our Pension could be right for you.

Give yourself peace of mind knowing that you and your family are protected with our Life Insurance or Mortgage Protection cover.

Whatever your savings goals are, we offer products to save for both yours and your child's future.

Pick a ready-made, professionally managed investment fund that best suits you, with a sustainable-focused and Shariah compliant option.

Our expert investment managers handle the investment details, so you can focus on what matters most.

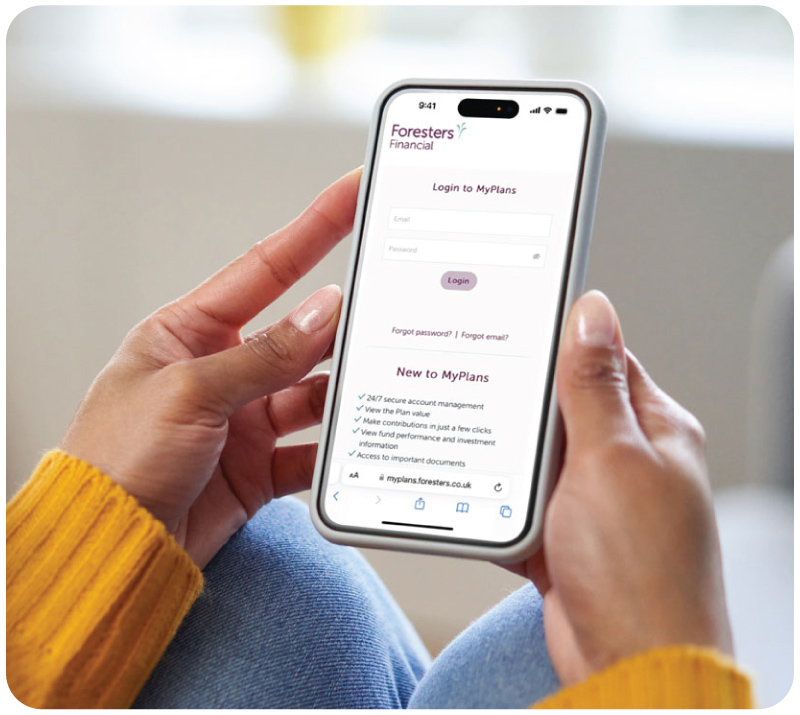

View performance, explore fund information, access your documents, make contributions and more 24/7 with MyPlans.

View our ISAs Explore child savings

Investing gives you the chance to grow your savings, but there’s a risk that the value of your investment could go down as well as up.

Be prepared to manage your savings once you turn 18. Explore your next steps and everything you need to know about continuing to invest in your future.

Making single or monthly contributions with us is simple, from as little as £10 anyone can can contribute towards a brighter future for them at age 18.

MyPlans makes it easier to manage your Plan securely online, helping you reach your savings goals.

It's easy to set up or amend contributions and gift to a child’s Plan at your convenience.

Keep up to date with the Plan, update your details, access important documents and more.

Watch our videos on how to create and navigate around your MyPlans account.

Login to MyPlans Create an account

With over 190 Foresters Financial Advisers across the UK, you have the choice to meet face-to-face in the comfort of your home, or by video appointment.

Our Advisers work for Foresters and are paid directly, so there is no extra cost for any advice given.

Rest assured, our Advisers will thoroughly explain any recommendations so you're completely informed. When it comes to deciding on a Plan, the choice is all yours.

Any profit we make is used to give back to our members in the form of member benefits. That's the benefit of being a mutual - we don't have any shareholders.

We give back with community volunteer activities where our members can contribute to making a positive impact, at no cost to them.

Being a Foresters member means you get access to discounts, educational and scholarship opportunities, rewards for making healthy choices with our wellness app, and more!

Member benefits are not regulated by the PRA or the FCA and may change in the future.

Master your money to become financially savvy. Learn to budget, save, and invest to confidently secure your future.

ISAs were designed to shield savings from tax. Explore the different types to find the best one for you and your future.

The 18 important things that you need to know about Junior ISAs to save tax-efficiently towards their first steps into adulthood.

When it comes to volatility, the general advice is to keep calm. Volatility in the market is not necessarily a bad thing.

Our UK-based customer services team is here to help with any questions you may have.

Looking for financial guidance? Our advisers are ready to assist in finding the right options for you.

Find out how we can help support you with any money worries or financial difficulties you may face.