Welcome to 'What IS A?'

Become more financially savvy and learn all the basics to be in control of your finances.

Become more financially savvy and learn all the basics to be in control of your finances.

The memes on social media tell us that young adults don't think they have been told enough about finance in life. We’re here to help you understand more than you may have been taught at school. Simply!

We would like to introduce the What IS A series, we hope you find this page helpful.

Meet Mike and find out everything you need to know about ISAs and how they can help you reach your future goals.

Meet Devamsha and find out everything you need to know about Lifetime ISA and how you can save for your home with a government bonus.

Meet Dan and find out everything you need to know about Child Trust Fund also known as a CTF and how you can make the most of your money at age 18.

What do you want to know more on?

It is important to understand basic financial documents as it will help you notice anything that doesn’t seem right and ensure you are able to budget appropriately to suit your needs.

Explore the different basic financial documents below and build your knowledge.

Pay Slips

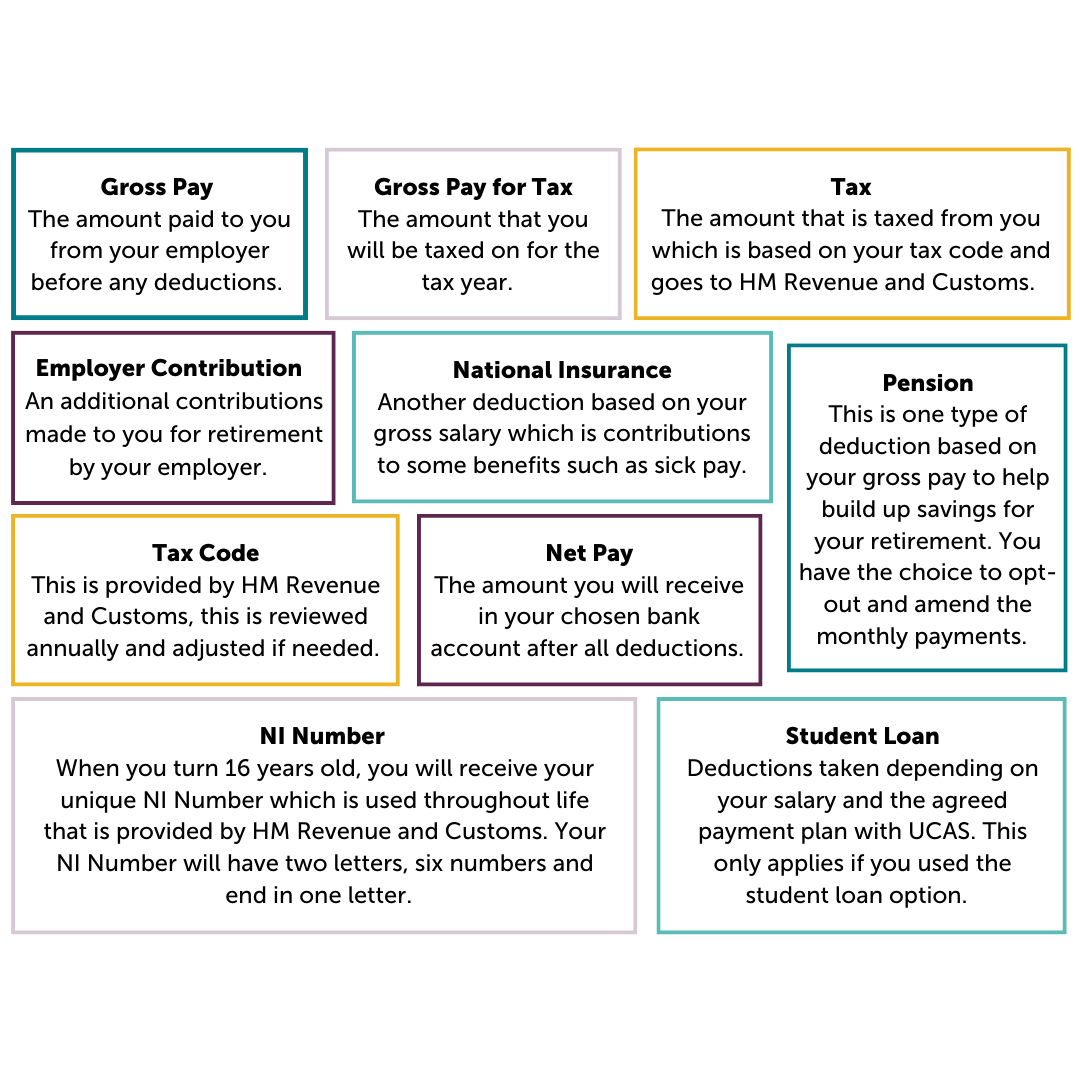

Who doesn't love a payslip - so when we are looking at how much money we are getting it is important to understand the terms used and the key things to look at:

We all have a personal allowance of up to £12,570 which is not taxable. Once you are earning £12,571 and above, depending on your personal salary it will depend on what tax band you will fall under.

• Registering as self employed with HMRC & paying taxes

• Work out whether you need to register for VAT

• Open a business bank account

• Make sure you are properly insured

• Keep accurate and up-to-date financial records

Bank Statement

Be honest, do you have a look at your Bank Statement? Well, if you answered no, check out reasons why you should check your statement.

Our 4 top tips:

Let’s talk about short and long-term savings, the reason why you should have both and their importance.

When you need to pay for something unexpected, your short-term savings will be perfect for times like this. If you needed to buy a new laptop or maybe have a staycation you could use this pot of money to cover the costs.

We all think about the future and the things we need to start saving for but have you thought about your what your savings will look like in 5 or more years time?

Having a short-term money pot will help you not take money out of your long-term savings which will affect your bigger future goals.

We all have different short and long-term goals and it’s important to map these out to help you manage your money.

Take some time and write down a few short and long-term goals and start planning your financial journey today.

Let’s really understand what is a credit score and the things you can do that will either affect it in a good or bad way. We will help break this down for you so you can steer away from any bad decisions.

You want to start making decisions to help build your credit score. Below are some options to help you do this. It’s important to have good credit as this makes you eligible for loans such as mortgages etc. Remember even though it’s a great way to build your credit score it could lead to a negative if you miss any payments.

Below are the same options that can help you build but also have a negative impact. Remember even though it’s a great way to build your credit score it could lead to a negative effect if you miss any payments or are over-borrowing money. This could then have an impact on your future for any loans as small as a phone contract to a mortgage or car lease.

We all want to save money and be savvier with our finances, right? If so then here are some tips to help you start saving today!

If you were to go to the store with a budget and buy food, what would you get? To be more savvy have a shopping basic list to make sure we have all the essentials and then top up each week after that. We have put together a list of shopping basics that are good for you to have.

There will always be a meal you can make such as pasta with your favourite jar of sauce. If you need more food, then you would simply set a budget and buy those items you need for the week. Yes, a budget is needed, so there are no accidental pick-ups going down those aisles you don’t need anything from. And take if from us don't go shopping when you are hungry!

Ok, let’s be honest do you keep buying unnecessary items you don’t actually need and in fact you can reuse them to help save money and the environment? I will take that as a yes!

Here are ways we can help save more money that we don’t tend to think of and in doing so we are helping to save our planet!

Mortgages and renting, are definitely something you should start thinking about. Continue to read to find out more to see which one you are interested in for your future plans and of course start saving towards this life goal!

Mortgages

Let’s stop and think about having your own house, that sounds fun, right? The thought of having your very own place and picking out how you would like to design your home to your desire.

But before we get carried away, do you know the process of how to get a mortgage?

If you don’t, that is fine, you will find that a lot of adults are shocked by the process of how it all goes.

We have outlined some of the important information you need to know which is part of the process of getting your own keys to your front door!

1

Check your affordability

This is key to see if you can even get a mortgage in the first place, you need to find this out.

You can do this by reaching out to a financial adviser or mortgage broker. Estate agents also usually have a contact so if you do not know of anyone they should be able to help. Usually the estate agents will only show you a property if you have been financially approved.

2

Accepted Offer

You have found the perfect home and the offer has been accepted. Yay!

There are a number of checks that you can have done on the home to ensure that it is worth its value and highlight any considerations. The most common one is a Home buyers survey, where someone will evaluate the house and let you know if it’s worth the purchase in other words to let you know if the house is falling apart. You can organise this through a Surveyor. There are also additional checks such as checking the heating and wiring that can be carried out. Your mortgage supplier is likely to also carry out an evaluation on the property.

3

In the finally stages

There is a mini check list. You need to appoint a solicitors/lawyers who will:

Renting

You may not want to get a mortgage at first or ever, so maybe renting would be right for you. So, we have outlined some of the important information you need to know which is part of the process of finding a place to rent.

1

Contracts

You can have different lengths of a contract either short-term or long-term. Normally the Landlord will have their property set for a period of time but you could possibly negotiate this.

A contract should mean no increases can be made during that time. If you are an awful tenant your landlord can break the clause, if your landlord is awful you can break the clause.

If you wish to end your tendency agreement earlier than agreed with your Landlord, check the contract to see what will be affected.

2

PCM

This stands for per calendar month which is the price you will pay each month to rent.

You can negotiate the costs of the rent, however, this will be impacted by demand and interest.

3

Deposit

Your deposit should be held by a 3rd party and not with the landlord.

You will commonly have to pay a month and a half of rent as your deposit and then you pay in advance for that month.

Therefore, budgeting here will be important as your first month’s bills will be high.

4

Landlord Visit

Even though your Landlord owns the place, did you know your landlord needs to give you advanced notice if they want to visit the property? You may sometimes deal directly with the landlord or it could be with an agency and this is dependent on the landlord and how they want the property to be managed.

5

Good to know

Here’s our little checklist for when you find the place that could be the one:

If you are a member with us, at age 18 you have access to Lifelong Learning where you can expand your financial knowledge and more!