Types of Junior ISAs

Junior ISAs are long-term savings accounts to save on behalf of a child, or for a child from age 16 to open their own Junior ISA. The child must be a UK resident. If your child was eligible for a Child Trust Fund (CTF), they can also transfer their CTF to a Junior ISA. Child Trust Funds were available to children born between 1st September 2002 and 2nd January 2011. Learn more about the differences between a CTF and Junior ISA >

Introduced by the Government in 2011, Junior ISAs can only be accessed by the child when they turn 18. At age 18 their savings could be used towards a first home, university costs, a gap year, rainy day and much more. Family and friends can also gift money into the Junior ISA which could take their savings further. The current annual contribution allowance is £9,000 this tax year.

There are two types of Junior ISAs – Cash Junior ISAs and Stocks and Shares Junior ISAs. As with Adult ISAs, you have the option to open both types.

Cash Junior ISAs

Cash Junior ISAs are low-risk ways of saving for a child and are available with a bank or building society. The money you save in their Cash Junior ISA pot will be guaranteed not to be less than any amount invested when the child reaches age 18.

However, with rising inflation (cost of living) and low interest rates, you are less likely to see considerable growth in cash. This is because inflation could eat away at the interest made from the Cash Junior ISA.

Stocks and Shares Junior ISAs

Stocks and Shares Junior ISAs invests in stock markets, which offer potential for growth in the long-term. Saving for a child from when they are only a few months old to when they turn into an adult at age 18 is a long time.

Research shows that, in every 10-year time period over the last 113 years, the probability of stocks and shares outperforming cash was 91% (Barclays Equity Gilt Study 2022).

However, unlike Cash Junior ISAs, the value of Stocks and Shares Junior ISAs will be dependent on investment performance and can fall and rise and your child may get back less than has been paid in.

There are a range of Stocks and Shares Junior ISAs to choose from. Some providers allow you to choose your own investment portfolio, one of the more risky methods of investing.

Most providers offer fund investment where investment decisions are made on your behalf by a fund manager. Some funds might be specialised investing only in one class of assets such as shares or only in one geographic area such us the UK.

Tracker funds follow the performance of a particular market index, such as the UK FTSE 100 Index. Balanced or mixed asset funds will invest in a range of asset classes such as shares and bonds to reduce the risks of market volatility and loss of capital. These funds are normally active or professionally managed, whereas tracker funds are passively managed.

At Foresters you have the choice to invest in a choice of stakeholder funds or in our Shariah compliant Junior ISA. To find out more, take a look at our Junior ISA page>

What type of Junior ISA works for me?

Deciding on the best Junior ISA for you could ultimately be down to your risk appetite. You may decide to open only one type of Junior ISA (Cash or Stocks and Shares). However, you do also have the option to open both types of Junior ISAs for the same child. The choice is yours!

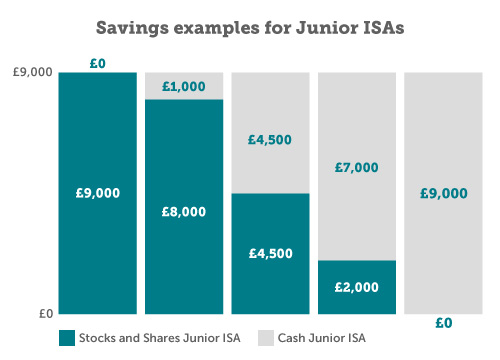

If you open both types of Junior ISAs, you can split the contribution allowance between the two accounts. The combined contributions into both types of Junior ISA may not exceed the overall annual limit, which is £9,000 for this tax year.

If you are looking for more information on this savings account, our What is a Junior ISA page> could help.

Our Stocks and Shares Junior ISA

Our Forester Life Junior ISA is a Stocks and Shares Junior ISA.

Our professional fund managers at Schroders will make investment decisions for you with a balanced approach, so you can really focus on what matters today whilst saving for the future.

Foresters Investment Choices

We believe in giving you the option to invest in what makes sense for you and your children. We have a choice of two stakeholder funds, with one that has a focus on Sustainability. Find our more about our Junior ISA>

We also offer a Shariah Junior ISA allowing you to save towards your child’s dreams in a Shariah compliant fund. Find our more about our Shariah Junior ISA>

The money saved on their behalf can be used towards a first home, driving costs, university costs, a rainy day and more. Find out more about the costs of some of their biggest milestones >

At Foresters Financial we also offer a personal financial planning service, where you can discuss your options with a Financial Adviser through face-to-face or video appointments. As they are paid directly, our Advisers will not charge for any advice given. Request a Financial Adviser >

You can find out more about our Stocks and Shares Junior ISA here >

Can I transfer to another type of Junior ISA?

It is possible to switch from a Cash Junior ISA to a Stocks and Shares Junior ISA. Please note you may be subject to exit fees from your current provider.

You should check with your new provider on fees if you wish to make a transfer. At Foresters we do not charge for Junior ISA transfers.

My child has a Child Trust Fund, can they switch to a Junior ISA?

If your child was entitled to a Child Trust Fund (CTF), you can transfer their Plan to a Junior ISA. Your child cannot have a Junior ISA and Child Trust Fund at the same time.

Please note you may be subject to exit fees from your current provider. At Foresters we do not charge for CTF to Junior ISA transfers.

Can I transfer my child's savings to Foresters Financial?

We accept transfers from both types of Junior ISAs to our Forester Life Junior ISA and this can be done online. We also accept online CTF to Junior ISA transfers.

We don’t charge entry, exit or transfer fees for CTF or Junior ISA transfers.

Learn more about transferring their savings to Foresters Financial >

If you have further queries about Junior ISAs, please read our FAQs page for more information.

If you're ready to give your child an exciting start to adulthood, open a Junior ISA online with Foresters Financial today.