Financing life's goals - how to become a savvy saver

What are you like at juggling today’s expenses with saving for tomorrow? It’s a great skill to have if you’ve got big life expenses ahead or are saving for a goal. Yes, it can be tricky but there’s also a lot you can do to hone your skills, develop solid habits and set yourself up to crush your savings goals. Read on to find out more.

Why save?

There are many reasons for saving, and your goals and motivations may be very different to those of others. Take time to think about your personal circumstances and what you want to achieve because saving is usually easier if you know why you’re doing it. Here are some common reasons:

Life goals and milestones

Life has many significant milestones and most of us have big goals and dreams for ourselves and our families too. Examples include buying a first home or car, going to university, starting a business, funding a dream wedding or gap year or starting a family. These are usually too expensive to pay for out of everyday budgets so saving up over time is the key to financing them.

Milestones in numbers

- £60,000 – the student loan price tag for a typical three-year university course

- £288,136 – the average cost of a home for a first-time buyer

- £166,000 – the average cost for a couple to raise a child to 18 (£220,000 for a lone parent)

The unexpected and emergencies

- Experts suggest you should have enough money in your emergency fund to cover essential expenses for between 3-6 months. Despite this, a third of UK savers say they would struggle to cover expenses for a month if they lost their main source of income.

The future

You may not know what you want your future to look like and it’s tricky to save for an abstract and often faraway time. But putting away money now will help build a nest egg and give you more options further down the line.

Peace of mind

Money worries can have a huge impact on wellbeing so having savings and well-established saving habits can help you feel in control and give you peace of mind. This isn’t just about building an emergency fund; knowing that you’re making progress towards milestones and goals can boost wellbeing too.

- Almost nine in 10 people in the UK say money worries keep them up at night

- 46% of people in problem debt have mental health problems and 18% of people with mental health problems are in problem debt

Top savings tips

So how do you juggle the expenses of today while also managing to save for tomorrow? Take a look at the tried and tested tips below.

1. Small amounts add up

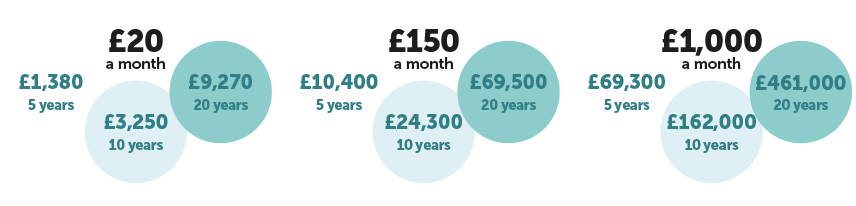

People often think they don’t have enough to make it worth saving but, over time, small sums can make a big difference. Yes, all your small contributions will add together to make a larger sum but you’ll benefit from the power of compounding too. This when the returns you make from your savings also make returns, creating a snowballing effect that helps your savings grow over time. And the longer you do this for, the more opportunity your savings have to grow.

Compounding is your ally, working with you to grow your savings, so never underestimate the potential future value of any small savings you can make today.

Here’s an illustration using our Foresters Financial Stocks & Shares ISA as an example. It shows how, helped by compounding, your savings have the potential to grow over time.

This illustration assumes an annual growth rate of 5% and an annual management charge of 1.5% (1% after 10 years). As it is an illustration, the figures are not guaranteed and you may get back less or more, depending on the performance of your investments. The figures assume monthly contributions are paid and include an increase of 3% inflation.

See more examples of how your savings could grow

2. Pay yourself first

Savvy savers have monthly budgets that include setting aside money for savings goals. They pay themselves first because they know that it’s much easier to save if you tuck the money away on payday rather than waiting to see if there’s anything left at the end of the month.

Take a look at your outgoings and see what you can put towards saving. If there isn’t much, can you make any switches, for example paying less for a phone or broadband contract or axing a TV subscription? Then get into the habit of paying yourself this money before it can go on anything else.

3. Automate your saving

An excellent way to get into the savings habit is to automate your savings. Just like you probably do to pay your bills, set up a Direct Debit. The money will move automatically from your current account into savings without you having to do anything more. This saves time and effort, will help remove the temptation to spend the money elsewhere and will ensure that you get into a regular rhythm of paying yourself first.

4. Choose the right home for your savings

Where you choose to save your money can have a big impact on the amount you’ll have in the future too so it’s important to think carefully about this. There isn’t one right answer and it can depend on factors such as the length of time you’re saving for, how much access you need to your cash and what you’re saving for.

Cash saving versus investing

If you’re saving for a short-term goal or to build an emergency fund, finding a high-interest cash savings account is usually a good option. But if you’re saving for a bigger item or longer-term goal and can afford to tie up your money for five or more years, investing – for example in an ISA, Junior ISA or Child Trust Fund – can play an important role.

Investing comes with more risks than cash savings because investments can fluctuate in value. This means if you need access to cash at short notice, you may need to sell your investments when they’ve dropped in value and you could get back less than you originally invested. But, when you invest for longer periods, you give your investments more time to recover from any dips. And, over the long term, if you choose your investments wisely, they have the potential to grow much more than cash savings.

Take the next step

With Foresters Financial you can start saving today with our simple, affordable plans.

Junior ISA – save on behalf of a child, from £10 a month or single contributions of £20. View our Junior ISA

Already with Foresters Financial

As with all stock market investments the value of the Plan can fall as well as rise, and you may get back less than has been paid in.