I am the parent - what do I need to know ➙

Your savings with Foresters Financial

Your Child Trust Fund will continue to be invested with us even after you turn 18.

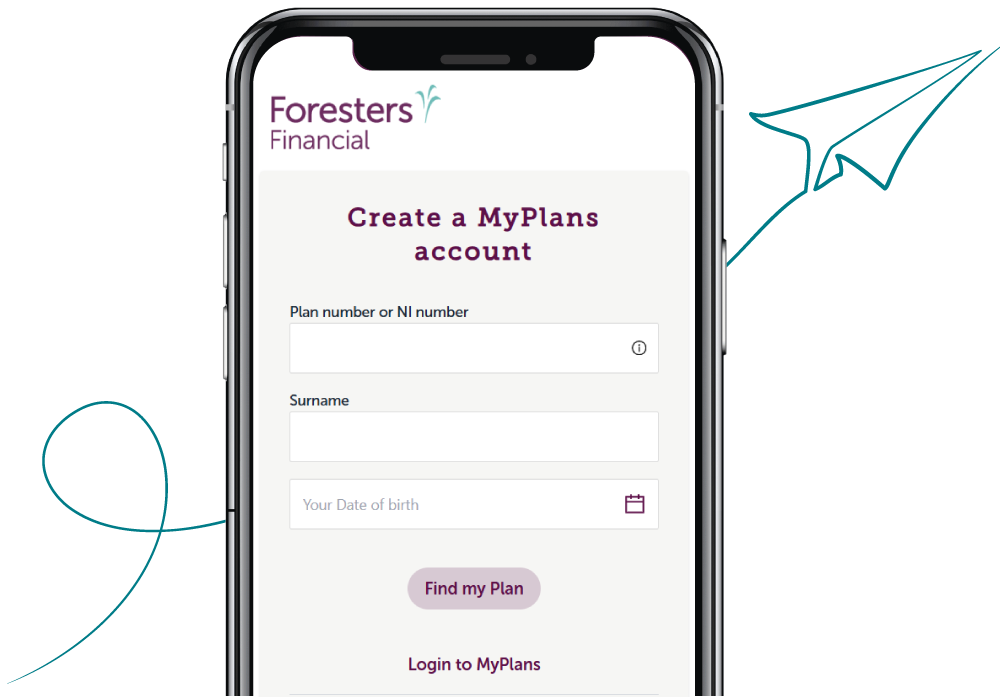

Setting up your account is easy

There’s nothing to choose, change, or commit to - this is simply how you view your Plan securely.

You'll need your Plan number (at the top of the letter we sent you) or National Insurance number, and your email address.

Why stay with Foresters?

Over 380,000 people trust us with their CTF savings - because keeping your savings invested can help turn your dreams into reality, like a first home or travelling the world.

Want to talk it through with someone?

Our savings experts are here to help you make confident financial decisions.

At Foresters, we have our own Financial Advisers to answer any questions you may have and provide personal advice to help you reach your future goals.

- Video chats or home visits

- Basic advice with no pressure

- No cost to you

"Since my Child Trust Fund matured, I have had great help from my Foresters Adviser on my next steps. My adviser is always happy to help with any questions and always explains everything thoroughly to me.”

What happens next with your savings?

There’s no rush. Your savings will continue to work hard, whatever you decide (if anything) to do with the money.

When you’re ready, here are some options to explore.

As with all investing the value of your Plan can fall as well as rise, and you may get back less than you have paid in.

Helpful information

You asked, we answered...

No, you don’t need to move your savings into your bank account. If you wish to move part of your money into your bank account you can, and the rest you can leave investing in an ISA for your future.

Child Trust Funds are savings accounts for children. The Government introduce these to help parents save for their child’s future. After your 18th birthday your Child Trust Fund will be yours to manage.

A Lifetime ISA if a great way to save towards your first home. You can save up to £4,000 each year, and the Government will add 25% (thats up to an extra £1,000 each year!).

Lifetime ISAs are a great way to boost your savings to get you on the property ladder quicker.

Yes! If you have a Shariah CTF, you can carry on investing in your future without having to compromise what you believe in. This is an ISA specifically for Islamic beliefs. A Shariah ISA has the same rules as a normal ISA, but the way your money is invested is checked by a Shariah advisory board to make sure investment decisions follow Islamic guidelines.

You usually get sent your National Insurance number in the post from HMRC just before your 16th birthday. You can also find this on any pay slips, P60 or tax letters.

If you don’t have any of these, you can use the Gov.uk NI number finder

The money from your Child Trust Fund can be moved into a Stocks and Shares ISA with Foresters. However, you cannot contribute to your ISA unless you become a UK resident. You are also only able to add the Lifetime ISA to your ISA in the future if you become a UK resident.

If you are a non-UK resident when you withdraw from your Plan, you should be aware that the amount you receive may be subject to taxation by the tax authority of the territory in which you live.

If your child is unable to manage their own money, please contact our Customer Services Maturity team who will be able to advise you on the process and next steps, 0333 600 0333.

Alternatively, find out more about your options on the Government website here.

A Child Trust Fund is an asset and matures when the Planholder turns 18. Therefore, anyone wanting to access a matured CTF must have the proper legal authority.

If your child has the capacity to do so, a young adult can choose to make a lasting power of attorney (LPA) to give someone they trust the legal authority to access their Child Trust Fund.

If your child does not have the capacity to manage their Child Trust Fund, their family or carers will need to apply to the Court of Protection and the Court will decide which type of order is necessary and in the best interests of the account holder.

If you believe that your child will not have the capacity to manage their Child Trust Fund when they reach adulthood, in good time before they turn 18 you should put in an application for a court order. This means that when the young person turns 18, the order will be ready and you should be able to access the matured Child Trust Fund.

If you are trying to access a Child Trust Fund on behalf of a young person, it is likely you will not have to pay fees if you:

- apply before their 18th birthday

- ask for a fee waiver through the Government Help with Fees scheme; or

- ask for a fee waiver due to exceptional circumstances

To note: If you are an appointee this does not allow you to access a CTF.