What does the Autumn Budget mean for investors? Read Schroders' experts take on the impact on UK equities, gilts, and the broader UK economy.

A mutual organisation helping to make a difference

We have over 3 million customers and members

Taking care of family finances for nearly 150 years

Forester Life have over £5.7bn funds under management

Why Choose Foresters

Est. 1874

Taking care of family finances for 150 years. With more than three million customers and members.

Helping is who we are

We are a mutual organisation helping to make a difference. We are driven to share, not shareholder driven.

Putting our customers first

Choice in how you do business with us, from managing your online account to having your Financial Adviser on hand.

Find out more about Foresters Financial 🡢

Our Financial Planning Service Brochure 🡢

About our costs and services

1. Important information

This document is designed to be given to consumers who are considering buying certain financial products. You need to read this important document. It explains the service you are being offered and how you will pay for it.

2. Whose products do we offer?

We only offer our own products for life insurance and for savings and investment products.

3. Which service will we provide you with?

For investment products we offer restricted advice. We will provide basic advice on a limited range of stakeholder products and in order to do this we will ask some questions about your income, savings and other circumstances, but we will not conduct a full assessment of your needs or offer advice on whether a non-stakeholder product may be more suitable.

Depending on the answers you provide during the fair and personal analysis we will provide a personal recommendation for any stakeholder savings or investment product deemed suitable. For protection products we will advise and make a recommendation for you after we have assessed your needs for life insurance.

For Child Trust Funds (CTFs) we offer guidance on the options available when the CTF has matured on the child’s 18th birthday. This service does not include any advice on the most suitable option to take or on any of our financial products.

4. What will you have to pay us for our services?

No fee. You will receive a brochure and/or a Key Information Document which will outline the capped charges relating to any particular stakeholder savings and investment product.

You will receive a quotation which will outline any other fees relation to any particular protection Plan.

Our Financial Advisers are directly employed by Forester Life and receive a basic salary and other employee benefits and have the potential to earn additional bonus if they meet certain targets.

5. Who regulates us?

Forester Life Limited, Foresters House, 2 Cromwell Avenue, Bromley BR2 9BF is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Our Financial Services Register number is 177898.

Our permitted business is advising on and arranging protection insurance and stakeholder investment products.

You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/firms/financial-services-registeror by contacting the FCA on 0800 111 6768 or 0300 500 8082.

6. What to do if you have a complaint

If you wish to register a complaint, please contact us:

• In writing: The Customer Relations Officer, Forester Life Limited, Foresters House,

2 Cromwell Avenue, Bromley BR2 9BF.

• By telephone: 0333 600 0333.

If you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service (FOS), visit www.financial-ombudsman.org.uk.

7. Are we covered by the Financial Services Compensation Scheme (FSCS)?

All Forester Life’s Plans are fully covered under the FSCS, so 100% of the value of your Plan is protected.

The FSCS is the UK’s compensation fund for customers of authorised financial services firms, including Forester Life. In the unlikely event that we cannot meet our obligations you will be entitled to make a claim for compensation from the FSCS.

You can find out more about the FSCS by visiting their website www.fscs.org.uk or by calling 0800 678 1100.

8. Conflicts of Interest Policy Summary

Forester Life conducts its business according to the principle that it must identify and manage conflicts of interest fairly, both between itself and our customers and between one customer and another.

Our Conflicts of Interest Policy, which is available on request, helps to ensure that we act honestly, fairly and professionally in accordance with the best interests of our customers.

The policy includes examples of the circumstances which constitute or may give rise to a conflict of interest and the procedures to be followed and measures to be adopted in order to manage such conflicts and prevent them from damaging the interests of our customers.

Using your personal information

We are committed to ensuring your privacy and personal information is protected. The details below outline what information we may hold, how we obtain it and for what purposes, who we share it with and why and your information rights. Further details are available within our Privacy Policy.

What we collect

Personal information is information that identifies you, is about you and is provided through your dealings with us. It includes your name, address, contact details, date of birth and Forester Life Plan details. In addition we hold information that we use to manage our relationship with you (contact, complaints and financial information) and information about how you interact with our website. In certain circumstances we may request and receive sensitive personal information about you.

How we use your information

The information you provide to Forester Life will be used for the following purposes:

• for setting up and administering your Plan;

• for communicating with and keeping you informed;

• for maintaining a record of complaints;

• for marketing of our products and services;

• for research and analysis; and

• for compliance monitoring and crime prevention.

Sharing your information

We share your information with our service providers, identity verification services such as credit reference agencies, and other parts of the Foresters organisation. We will not disclose any of your information to any other body or organisation except to prevent crime or if required by regulations or any law enforcement organisation.

Retaining your information

We will retain your information for as long as you are a Forester Life Planholder, and in accordance with our data retention guidelines and legal and regulatory obligations.

Your rights and your information

Your rights in relation to your information are set out in our Privacy Policy, on foresters.com or on request from Customer Services.

The policy provides more detailed information on how to view, correct, withdraw or otherwise change the way we use your personal information.

Making a complaint

If we have been unable to satisfy your concerns regarding any aspect of the processing or handling of your information you can contact the Information Commissioners Office on: telephone helpline: 0303 123 1113; email: visit www.ico.org.uk/global/contact-us/email/; post: Information Commissioners Office, Wycliffe House, Water Lane, Wilmslow, Cheshire SK9 5AF.

Laws and language

All Forester Life Plans are subject to the law of England and Wales. We will always communicate with you using the English language.

Taxation

Information is based on our current understanding of taxation as at December 2021. Tax treatment depends on individual circumstances and may be subject to change in the future.

What IS A

Become more financially savvy and learn all the basics to be in control of your finances.

See what our customers have to say...

❝ Always happy with his explanations of products based on the information I give him. He listens to my needs if circumstances have changed. Very informative ❞

❝My Financial Adviser was extremely friendly and thorough and talked me through anything I was unsure about. I felt comfortable and am looking forward to saving for my daughters future with you! ❞

❝We’re so happy to be part of the Foresters, sound financial advice from friendly advisers. We couldn’t be happier with the whole experience. ❞

Personal Insurance

Personal Insurance is a protection Plan that offers you cover against death, critical illness, terminal illness and permanent disability.

Mortgage Protection

Mortgage Protection is a protection Plan that offers you cover designed to repay a mortgage in the event of death, critical illness, terminal illness and permanent disability.

Individual Savings Account (ISA)

Our ISA has the option of combining a Stocks and Shares ISA and a Lifetime ISA in one Plan. You can start saving for those future milestones from as little as £20 up to £20,000 this tax year.

Savings & Investment Plan

Our Savings & Investment Plan is designed to provide flexible terms, low charges and medium to long-term growth in risk-controlled funds with no savings limit.

Child Trust Fund

Looking after over 1.3 million children's savings Plans, we are here to help you save for your child’s future. You can no longer open a Child Trust Fund, but you can still contribute and transfer to us.

Personal Pension

Whether retirement seems far off or just around the corner, a pension could ensure a more comfortable later-life. If you do not already have a workplace pension our Personal Pension Plan may be a suitable option.

Financial markets have recently experienced volatility due to the sharp rise in global inflation. We have seen large falls in many types of investments, including bonds and equities that your fund may invest in. Our general advice is to keep calm and think about your medium to long-term investment plans. For more information, read our article, investing in volatile market.

Giving you the choice to invest your way

Our professionals make investment decisions for you - making investing for the future easy. With our ISA, Lifetime ISA and Junior ISA you have the option to invest in a choice of funds.

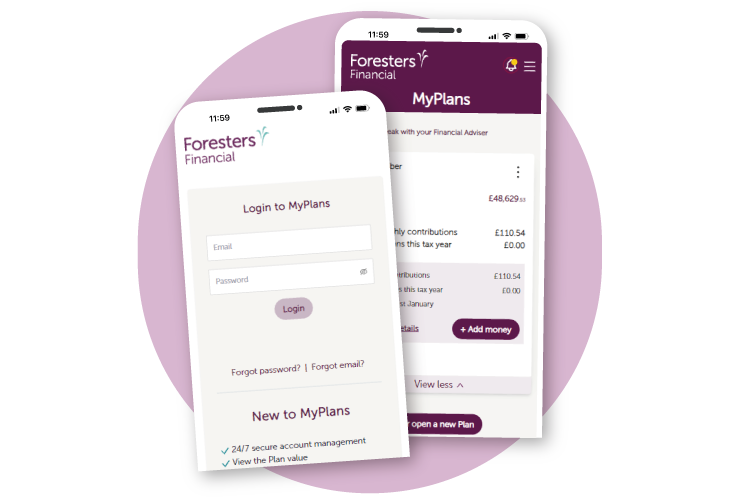

MyPlans

If you have a savings plan with us, you can manage your Plan online with MyPlans. MyPlans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

To view your Matured CTF ISA, ISA, Savings & Investment Plans, Child Trust Funds or Junior ISAs online all you need is your Plan number, date of birth(s) and postcode to set up your My Plans account.

Watch our quick 3 minute video on how to create your MyPlans account.

MyForesters

If you have a Plan with Foresters and are aged 18 or over, you can access your benefits through MyForesters. On MyForesters, you can access LawAssure, apply for grants, check your current grant applications, join community and fun family activities, Lifelong Learning and more.

To register for MyForesters you’ll need:

- Your Plan number

- Your email address on our records